All Categories

Featured

Table of Contents

Trustees can be household participants, trusted individuals, or monetary institutions, depending on your preferences and the intricacy of the trust. The goal is to ensure that the trust is well-funded to meet the youngster's long-term financial needs.

The duty of a in a kid support trust fund can not be underrated. The trustee is the private or organization in charge of handling the trust fund's properties and ensuring that funds are distributed according to the regards to the depend on agreement. This consists of making certain that funds are utilized exclusively for the child's advantage whether that's for education, healthcare, or daily expenditures.

They must also offer regular records to the court, the custodial parent, or both, depending upon the regards to the trust. This responsibility ensures that the count on is being managed in such a way that advantages the youngster, protecting against misuse of the funds. The trustee also has a fiduciary task, indicating they are legitimately bound to act in the most effective interest of the youngster.

By buying an annuity, parents can guarantee that a repaired quantity is paid frequently, no matter any changes in their revenue. This provides assurance, knowing that the youngster's needs will certainly proceed to be met, no matter the monetary conditions. Among the key benefits of utilizing annuities for kid support is that they can bypass the probate process.

Is there a budget-friendly Variable Annuities option?

Annuities can additionally provide protection from market variations, making certain that the kid's monetary assistance stays steady even in unstable financial conditions. Annuities for Child Support: An Organized Option When setting up, it's vital to take into consideration the tax ramifications for both the paying parent and the child. Counts on, depending on their framework, can have different tax treatments.

While annuities provide a stable revenue stream, it's crucial to understand just how that revenue will certainly be tired. Depending on the framework of the annuity, payments to the custodial moms and dad or youngster may be considered taxable revenue.

One of one of the most significant advantages of utilizing is the capacity to safeguard a child's financial future. Depends on, particularly, offer a degree of defense from lenders and can make certain that funds are made use of sensibly. For circumstances, a count on can be structured to ensure that funds are only used for certain functions, such as education and learning or medical care, stopping misuse - Annuity riders.

How do I receive payments from an Annuities For Retirement Planning?

No, a Texas kid support trust fund is especially developed to cover the youngster's crucial requirements, such as education and learning, health care, and everyday living costs. The trustee is legitimately obliged to ensure that the funds are utilized solely for the benefit of the youngster as laid out in the trust arrangement. An annuity offers structured, foreseeable payments in time, making certain constant monetary support for the child.

Yes, both child assistance trust funds and annuities come with prospective tax obligation ramifications. Trust fund earnings may be taxed, and annuity settlements could additionally be subject to taxes, depending on their structure. Considering that lots of senior citizens have actually been able to save up a nest egg for their retirement years, they are often targeted with fraudulence in a way that more youthful individuals with no financial savings are not.

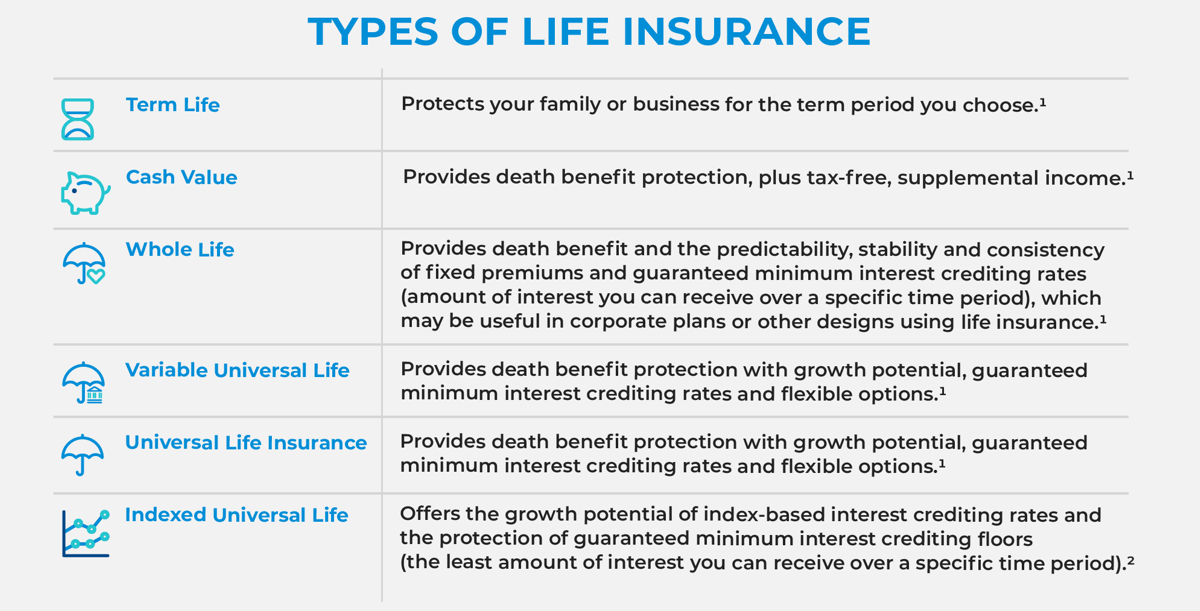

The Lawyer General offers the following pointers to think about before acquiring an annuity: Annuities are complicated investments. Annuities can be structured as variable annuities, dealt with annuities, immediate annuities, delayed annuities, and so on.

Consumers should read and understand the prospectus, and the volatility of each financial investment detailed in the syllabus. Investors ought to ask their broker to discuss all terms in the syllabus, and ask concerns concerning anything they do not comprehend. Fixed annuity items may likewise bring risks, such as lasting deferment periods, preventing investors from accessing all of their cash.

The Attorney General has filed legal actions against insurer that marketed improper delayed annuities with over 15 year deferral periods to investors not expected to live that long, or who need access to their cash for healthcare or assisted living expenditures (Annuity accumulation phase). Financiers should make sure they recognize the long-term repercussions of any kind of annuity acquisition

What happens if I outlive my Annuity Accumulation Phase?

The most significant cost linked with annuities is usually the surrender fee. This is the percentage that a customer is charged if he or she withdraws funds early.

Consumers may want to consult a tax obligation expert before investing in an annuity. The "security" of the investment depends on the annuity. Beware of representatives who aggressively market annuities as being as risk-free as or far better than CDs. The SEC alerts customers that some sellers of annuities products advise customers to change to one more annuity, a method called "churning." Representatives might not adequately disclose charges associated with switching investments, such as new surrender charges (which normally begin over from the day the item is switched), or significantly transformed benefits.

Agents and insurance provider may provide rewards to entice financiers, such as added interest factors on their return. The benefits of such "bonus offers" are typically surpassed by increased costs and management expenses to the capitalist. "Bonuses" might be simply marketing tricks. Some unethical representatives motivate customers to make impractical investments they can't manage, or buy a long-term deferred annuity, although they will need access to their money for wellness care or living costs.

This section offers info useful to senior citizens and their families. There are numerous events that might affect your benefits. Gives information regularly asked for by brand-new senior citizens including changing health and wellness and life insurance policy alternatives, Soda pops, annuity repayments, and taxable parts of annuity. Explains just how benefits are affected by events such as marriage, separation, death of a spouse, re-employment in Federal service, or lack of ability to take care of one's finances.

How do I apply for an Retirement Annuities?

Trick Takeaways The recipient of an annuity is a person or organization the annuity's owner marks to receive the agreement's survivor benefit. Different annuities pay out to beneficiaries in different methods. Some annuities may pay the beneficiary steady settlements after the agreement owner's death, while various other annuities may pay a fatality benefit as a round figure.

Table of Contents

Latest Posts

Breaking Down Fixed Interest Annuity Vs Variable Investment Annuity Key Insights on Your Financial Future Defining the Right Financial Strategy Features of Annuities Fixed Vs Variable Why Choosing the

Decoding Fixed Annuity Vs Variable Annuity Key Insights on Your Financial Future Breaking Down the Basics of Investment Plans Features of Smart Investment Choices Why Annuity Fixed Vs Variable Can Imp

Decoding Immediate Fixed Annuity Vs Variable Annuity A Closer Look at How Retirement Planning Works What Is the Best Retirement Option? Advantages and Disadvantages of Annuities Fixed Vs Variable Why

More

Latest Posts